HUBEI HUIXIAN OPTICDISPLAY TECHNOLOGY CO.,LTD

The panel industry, cyclical rhythm 'upgrading': it's not just 'copy and paste'

发布时间:2024-12-10

Chinese panel leaders represented by TCL Technology are replacing 'old thinking' with 'new methods'. The companies not only implement high-quality development for listed companies but also adhere to the mission of creating value for shareholders. These changes will further alter the traditional image of the entire panel industry in the eyes of investors.

From over 10 billion in profit in 2021 to over 10 billion in losses in 2022, the semiconductor display industry has struggled to survive amid cyclical fluctuations over the past two to three years.

Severe adjustments have forced the elimination of outdated production capacity. The industry has finally begun to show positive changes.

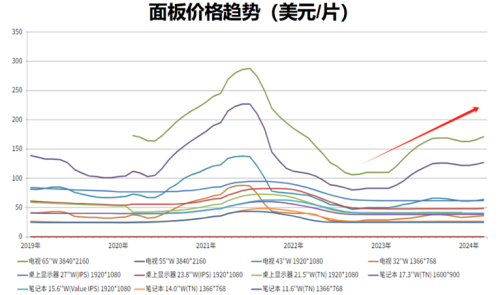

Starting in March 2023, signals of industry recovery have strengthened, with mainstream panel prices rising for several consecutive months, gradually returning above the profit level. Although there was a slight adjustment in the off-season at the end of the year, as we enter 2024, panel prices have returned to an upward trend and have welcomed new breakthroughs. Overall, the price starting point is higher than the same period last year, driving up the profit center.

From a performance perspective, 2023 to 2024 is a pivotal year for the panel industry, transitioning from losses to profits. Historically, such turning points often correspond to significant cycles of boom and bust.

However, considering the backdrop of global supply chain restructuring and the exit of Japanese and Korean companies, this round of the panel industry's upward cycle is not merely a simple repetition of history. With changes in the development and competitive logic of the panel industry, a 'new era' for the panel industry will also begin under the new cycle.

The harsh winter has passed, and the turning point has arrived.

Looking ahead, one must first analyze history. Every transformation in the panel industry cannot escape the cycle of 'strong cycles.'

The cyclical pattern can be summarized well: when market demand for new products increases and supply cannot meet demand, product prices soar, leading to a brief period of high investment returns that attract large amounts of new capital; new investments bring additional production capacity, which develops rapidly until supply exceeds demand, causing prices to fall; once production capacity is cleared and the industry is reshuffled, it leads to changes in the supply structure.

A cycle lasts a few years, repeating this process. The so-called 'competitiveness' of panel companies is nothing more than this:

During the upward phase, they engage in frenzied financing and capacity expansion; in the downward phase, they rely on cash reserves to outlast competitors, competing on who can 'make money' better and who is more willing to gamble on expansion—essentially, it is a competition of capital scale.

With such 'competitiveness,' in the 1990s, Korean panel manufacturers invested heavily to expand production during the industry's low point, surpassing the initial dominant player, Japan. At the turn of the century, another cycle emerged, allowing Taiwan, China, to join the game; another decade later, manufacturers from mainland China gradually became important players in the global panel market.

Under the 'rollercoaster' of strong cycles, there is excessive competition in production capacity and chaotic internal competition, which not only hinders the stable development of the entire panel industry but also leads to waste of social production materials.

In fact, this is also the confusion of panel manufacturers. In the face of the long-standing 'cycle curse' in the industry chain, players at the table are also contemplating ways to break the cycle.

From the new cycle to the new era

Before the 'window paper' is broken, the fundamentals of the industry have already undergone significant changes:

Fundamental One: Decades of extreme competition have catalyzed continuous iteration of panel industry equipment and production lines. The current G11 production line is already the 'ceiling' of the highest generation line, significantly raising the capital barriers for new players to enter. Most production lines above G8.5 are now concentrated in the hands of mainland panel manufacturers.

According to public data, there are currently about 27 LCD production lines of 8.5 generations and above globally, with mainland Chinese panel manufacturers collectively owning 19 of these lines, including 15 G8.5/G8.6 and 4 G10.5/G11 LCD production lines. The competitive advantage is evident, and the resulting increase in concentration is a natural outcome.

Consulting agency data shows that in 2023, the market share of LCD TV panel shipments from mainland Chinese manufacturers rose to 70%, with BOE and TCL Technology ranking as the top two globally. In fact, since 2017, mainland China's LCD production capacity has ranked first in the world.

Fundamental Two: Represented by BOE and TCL Technology, mainland Chinese panel manufacturers have worked hard to achieve significant relative competitive advantages in technology research and development, production operations, and supply chain management, gaining industry initiative.

Main panel manufacturers' EBITDA% trends, compiled from public financial reports.

If the two fundamentals are the premise of the 'new era,' then the massive losses in 2022 are the fuse for the 'new era.' Manufacturers that have experienced significant losses are increasingly demanding stable profits and are beginning to adopt production strategies based on demand.

Starting from October 2022, mainstream panel prices gradually stabilized, and by March 2023, a seven-month rising trend began, entering 2024 with a slow upward trajectory once again.

At the same time, the industry landscape is further optimizing. Former giants like Samsung and Panasonic have completely exited the LCD field, and events such as Guangzhou LGD urgently seeking to sell and Sharp's plans to shut down its Japanese factory have also become important driving factors. Globally, there are no new LCD production line plans, and the overall growth rate of LCD production capacity is almost stagnant in the coming years.

It is worth mentioning that in the OLED sector, Chinese manufacturers are also continuously narrowing the gap with Korean manufacturers in terms of technology and scale. Statistics released by CINNO Research on April 22 show that in the first quarter of 2024, the market share of AMOLED smartphone panel shipments by region shows that the share of the Korean region has narrowed to 46.6%; domestic manufacturers' shipment share accounts for 53.4%, an increase of 15.6 percentage points year-on-year and 8.5 percentage points quarter-on-quarter, with the share exceeding 50% for the first time. It can be anticipated that leading Chinese manufacturers represented by BOE and TCL Technology will replicate the successful path of LCD in the OLED field in the future.

The cycle is upward, and the future is promising.

Qunzhi Consulting predicts that 2024 will be a year of comprehensive recovery and profit restoration for the panel industry, with an expected annual growth rate of 11%. Omida even predicts that the peak price of the panel industry this year will occur in the third quarter, which, according to historical data, is also the peak shipping season for the panel industry.

In terms of demand, the electronics industry, as a highly globalized industry, has seen global TV sales stabilize at around 200 million units per year over the past decade, driving stable panel shipment volumes; at the same time, the trend towards larger sizes is becoming a strong factor driving the growth of panel shipment area.

According to third-party data, by the end of 2023, the average size of global TVs has grown to around 50 inches. Every 1-inch increase brings about a 3%-4% growth in global area, indicating a significant growth trend.

It is worth mentioning that despite the fierce competition in technology iteration and the discourse power of OLED, professional institutions analyze that the total value of LCD panels last year was approximately $90 billion, OLED was $24 billion, and Micro LED was $400 million. Undoubtedly, LCD remains the most mainstream display panel application technology, especially in non-mobile medium and large display application scenarios, where its position is unshakable.

It can be foreseen that as a new round of industrial upcycle arrives, the Chinese panel manufacturers that already have absolute discourse power in LCD will welcome a new spring.

Taking TCL Technology as an example, according to its 2023 annual report, TCL Technology's total revenue for 2023 was 174.367 billion yuan, a year-on-year increase of 4.69%; net profit was 4.781 billion yuan, a year-on-year increase of 167.37%; net profit attributable to shareholders was 2.215 billion yuan, a year-on-year increase of 747.60%, and the net operating cash flow reached 25.315 billion yuan, achieving strong growth against the trend.

The annual report also disclosed that the shipment area of its LCD products of 55 inches and above accounted for 79%, and the area of products 65 inches and above accounted for 51%; its TV panel market share remained among the top two globally, with 55-inch and 75-inch products holding the global first place, and 65-inch products holding the global second place.

Performance recovery directly benefits investors. TCL Technology's annual report disclosed a plan for a cash dividend of 1.5 billion yuan for 2023, with a dividend payout ratio of 68%. It is worth mentioning that according to Wind data statistics, from 2011 to 2022, the total cash dividends paid by TCL Technology to all shareholders have reached 11.86 billion yuan, and with the 2023 dividend amount, the total cash dividends have exceeded 13.3 billion yuan.

The 'New National Nine Articles' mentioned that incentives for high-quality dividend companies will be increased, with multiple measures taken to promote an increase in dividend yield. In this regard, TCL's years of practice align with the aforementioned requirements.

In addition, in the new era of the panel industry gradually returning to rational competition, the significant capital investment pressure that panel manufacturers previously used for cyclical capacity expansion will be significantly reduced, which will greatly liberate the cash dividend capacity of panel manufacturers. This means that for investors, panel listed companies like TCL Technology will have greater potential for cash dividends in the future, and their value investment attractiveness will be significantly enhanced.

Conclusion

In the new era of business competition, companies are required to prioritize stable profitability. The market fluctuations over the past years have made industry players eager to return to a rational and steady growth track, which is highly aligned with the current government's guidance direction.

On one hand, with the accelerated integration of the industry, demand-driven production, and the recovery of downstream demand, industry competition is expected to return to rational health, and panel manufacturers will continue to maintain reasonable profits.

On the other hand, under the guidance of the concept of high-quality development, companies are expected to use more of their future profits for dividends rather than disorderly expansion, which will make the long-term value of the panel industry more prominent.

Leading Chinese panel manufacturers represented by TCL Technology are replacing 'old thinking' with 'new methods'. The company not only implements high-quality development for listed companies but also adheres to the mission of creating value for shareholders, all of which will further change the traditional image of the entire panel industry in the eyes of investors.

Under the 'elevated' cyclical law, the panel industry is moving towards a warmer and more lasting spring.

Previous Page

Contact Information

E-mail: johnding@gingkotech.com

Address: No.38, Development Second Road, Anlu City, Hubei Province